ADA Price Prediction: Technical Breakout and Fundamental Catalysts Point to 30% Rally Potential

#ADA

- Technical Strength: ADA maintains above crucial $0.80 support with bullish MACD momentum indicating strengthening upward movement potential

- Macro Catalysts: Federal Reserve rate cut speculation provides tailwinds for risk assets including cryptocurrencies, supporting ADA's appreciation thesis

- Whale Accumulation: Significant institutional inflows and whale activity create underlying demand pressure that could drive prices toward analyst targets of $2

ADA Price Prediction

Technical Analysis: ADA Shows Bullish Momentum Above Key Support

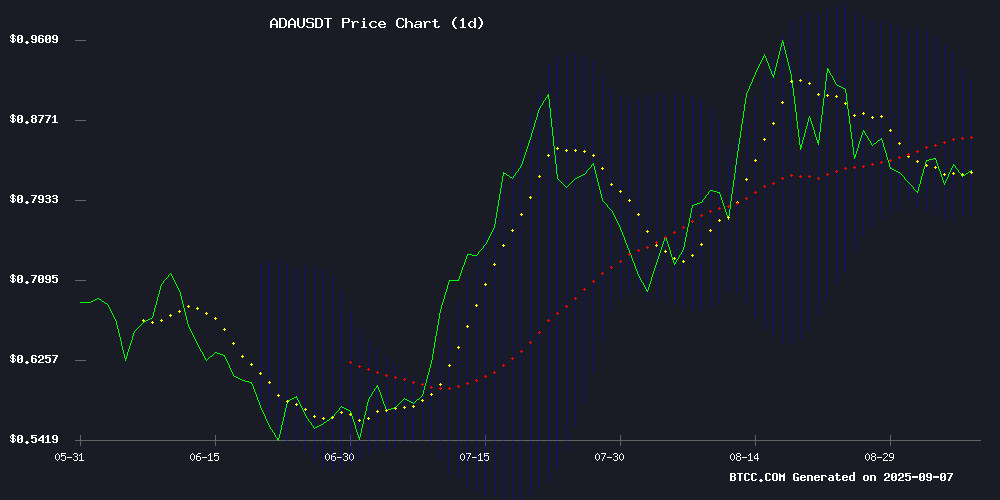

ADA is currently trading at $0.8283, holding above the critical $0.80 support level identified by analysts. The price sits slightly below the 20-day moving average of $0.8483, suggesting potential resistance overhead. MACD indicators show bullish momentum with the MACD line at 0.052741 above the signal line at 0.028286, while the positive histogram reading of 0.024456 confirms strengthening upward momentum. Bollinger Bands indicate ADA is trading in the lower portion of the range with the upper band at $0.9186 and lower band at $0.7780, suggesting room for upward movement toward the middle band resistance.

According to BTCC financial analyst Sophia, 'The technical setup suggests ADA is building momentum for a potential breakout. Holding above $0.80 is crucial for maintaining bullish structure, while a MOVE above the 20-day MA could trigger further gains toward the upper Bollinger Band.'

Market Sentiment: Fed Speculation and Whale Activity Fuel ADA Optimism

Market sentiment for ADA appears increasingly bullish amid growing Federal Reserve rate cut speculation and significant whale accumulation. Recent headlines highlight Cardano's resilience at key support levels while analysts project substantial upside potential, including targets reaching $2 by year-end. The combination of macroeconomic tailwinds from potential Fed easing and substantial institutional interest creates a favorable environment for ADA appreciation.

BTCC financial analyst Sophia notes, 'The convergence of technical strength and positive fundamental catalysts, particularly Fed policy expectations and whale inflows, supports the case for ADA's upward trajectory. The $0.80 level has proven to be strong support, and breaking above technical resistance could accelerate moves toward higher targets.'

Factors Influencing ADA's Price

Cardano Eyes 30% Rally as Fed Rate Cut Speculation Grows

Cardano (ADA) is flashing bullish signals as crypto markets anticipate a potential Federal Reserve interest rate cut in September. The TD Sequential indicator recently triggered a buy signal on ADA's daily chart, with analysts identifying $0.86 as a key resistance level to watch. A breakout could propel the token back above $1 for the first time since mid-August.

Founder Charles Hoskinson predicts a 'gigachad bull run' following expected monetary policy easing and regulatory clarity. The project stands to benefit from renewed altcoin momentum should the Fed pivot, with technical patterns suggesting the recent correction may be nearing its end.

Cardano Holds Strong Support as Analyst Eyes Key Levels at $0.80

Cardano ($ADA) demonstrates resilience in a volatile market, maintaining its position above a critical support level of $0.80-$0.81. Crypto analyst Michaël van de Poppe highlights potential entry points for traders, suggesting $0.74 as an attractive level if further pullbacks occur.

The asset currently trades at $0.82 with a neutral daily RSI of 47. A breakout above immediate resistance at $0.85 could reignite bullish momentum, while the $0.80-$0.81 zone continues to serve as a defensive line against downward pressure.

Market participants watch these technical levels closely as Cardano's ecosystem development progresses. The asset's ability to hold key support despite broader market uncertainty signals underlying strength.

Cardano Price Prediction: Could ADA Hit $2 by 2025 on Whale Inflows?

Cardano is attracting renewed interest as large investors, or 'whales,' accumulate significant amounts of ADA. Over 150 million ADA has been added to whale wallets in recent weeks, signaling growing confidence in the asset. This accumulation has helped stabilize prices around $0.85 and reduced downside risk, fostering a bullish sentiment.

Technical analysis reveals a symmetrical triangle pattern forming on ADA's chart, often a precursor to breakout movements. A successful breakout could propel ADA past key resistance levels, with some analysts projecting a climb to the $1.50-$2.00 range by 2025. Historical trends suggest Cardano gains momentum when technical and on-chain signals align.

Meanwhile, speculators are diversifying into emerging projects like MAGACOIN FINANCE alongside ADA. The sustained whale activity and favorable chart patterns position cardano for potential upward movement, drawing attention from broader market participants.

How High Will ADA Price Go?

Based on current technical indicators and market sentiment, ADA shows potential for significant upward movement. The combination of strong support at $0.80, bullish MACD momentum, and positive fundamental catalysts suggests a likely test of the upper Bollinger Band around $0.9186, representing approximately 11% upside from current levels. Beyond this, analyst projections targeting $2 by year-end appear ambitious but possible if current whale accumulation and Fed speculation momentum continues.

| Price Level | Significance | Probability |

|---|---|---|

| $0.9186 | Upper Bollinger Band Resistance | High |

| $1.20 | 30% Rally Target | Medium |

| $2.00 | Analyst Year-End Projection | Low-Medium |

BTCC financial analyst Sophia emphasizes that 'while technicals support near-term gains toward $0.92, achieving higher targets requires sustained whale interest and favorable macro conditions. The $0.80 level remains critical support for maintaining bullish momentum.'